In Part 1, we discussed why bookkeeping matters, how small businesses can get started using free tools, and why having a separate business bank account is critical.

Now, in Part 2, we focus on the how.

Bookkeeping is not rocket science. It is a simple, repeatable process that any small business owner, freelancer, or online seller can follow. Once you understand the flow, it becomes a habit – not a headache.

In this article, we will clearly explain:

🛒 The purchase process (PO & GRN)

🧾 Invoices and why they matter

💰 How to record income and expenses

📊 How to create a final statement

🔍 How to analyze results for decisions

🧮 Basics of assets, liabilities, and equity

By the end, you’ll have a simple bookkeeping system you can use confidently without overwhelm.

🔄 The Core Bookkeeping Flow: Purchases, Sales, Records & Reports

Think of bookkeeping like a money river:

⬆️💵Money flows in → income

⬇️💸Money flows out → expenses

📊Reports are the checkpoints that show where you stand

Every small business follows this basic cycle:

Purchases → Sales → Records → Reports → Decisions

Let’s break it down step by step.

🛒 01. Purchases: The PO / GRN Process (Buy Smart, Track Everything)

Whenever you buy stock, raw materials, or services, you should follow a simple PO and GRN system. This keeps your purchases controlled and documented.

📝 Step 1: Create a Purchase Order (PO)

A Purchase Order (PO) is a document created before buying from a supplier.

It includes:

👤Supplier name

🗂️Items and quantities

💰Price and total value

📝Payment terms (example: “Pay in 30 days”)

You can create a PO using:

Free bookkeeping software (Wave, Zoho Books)

Google Sheets or Excel

📌 Why PO matters

Prevents overbuying

Protects against supplier disputes

Helps plan cash and inventory

👉 A PO is simply official approval to buy.

📦 Step 2: Receive Goods with a GRN

A Goods Received Note (GRN) is prepared when goods arrive.

Check:

Quantity received

Item condition

Match with the PO

You can:

Fill a simple GRN form

Or take a photo of the delivery note and store it

📌 Why GRN matters

Confirms what you actually received

Stops paying for missing or damaged goods

Improves inventory accuracy

Simple flow:

PO → GRN → Supplier Invoice

💡 Pro Tip: Zoho Books and similar tools auto-generate POs and GRNs.

🧾 Invoices: What They Are and Why You Need Them

An invoice is your official request for payment.

It is not just a receipt — it is legal proof of a sale.

Every sale should have an invoice.

📄 What an Invoice Includes

Your business details

Customer details

Product or service description

Quantity and price

Total amount due

Due date and payment terms

🔍 Why Invoices Are Critical

Create proper income records

Speed up customer payments

Protect you in disputes

Required for taxes and audits

👉 No invoice = delayed payments = cash flow problems.

Example:

Sold T-shirts worth $500

Invoice: 5 × $100 = $500 due by Jan 30

Record income when payment is received.

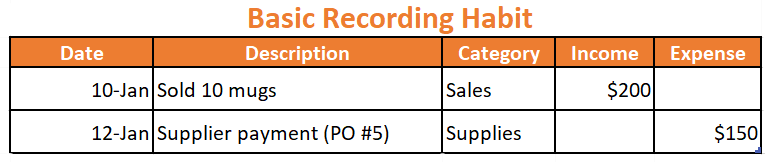

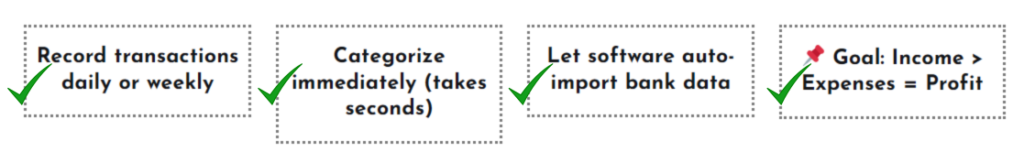

💰 03. Recording Income & Expenses (The Daily Habit)

This is the heart of bookkeeping — consistency matters more than complexity.

| Record | Categorize Income Like |

|---|---|

| Sales from invoices | Product Sales |

| Cash payments | Service Income |

| Online transfers | Online Orders |

| Record | Categorize Expenses Like |

|---|---|

| Supplier payments (POs) | Supplies / Stock |

| Rent & Utilities | Rent / Electricity / Water |

| Marketing & Ads | Advertising / Promotions |

| Transport & Fuel | Transport / Delivery |

| Office Supplies | Office / Operating Costs |

🧮 04. Assets, Liabilities & Equity (The Simple Equation)

Everything in bookkeeping comes back to one basic formula:

Assets = Liabilities + Equity

🟢 Assets – What the Business Owns

Cash and bank balance

Inventory (stock)

Equipment and tools

Unpaid customer invoices

🔴 Liabilities – What the Business Owes

Supplier bills

Loans and overdrafts

Unpaid taxes

🔵 Equity – Owner’s Real Value

Owner investment

Retained profits

📌 Why this matters

This separation shows the true financial health of the business — not just cash on hand.

📊 05. Creating the Final Statement (Profit & Loss)

At month-end, generate your Profit & Loss (P&L) Statement from your software.

📄 What P&L Shows

Total Income – Total Expenses = Net Profit (or Loss)

Example:

January P&L

Income: $5,000

Expenses: $3,500

Rent: $1,000

Supplies: $1,200

Marketing: $800

Other: $500

Net Profit: $1,500

📌 Always match this with your bank balance and fix errors early.

🔍 06. Analyzing the Final Statement (Turn Numbers into Action)

Numbers are useless unless you analyze them.

Ask these key questions:

✅ Profit Check

Is profit positive or negative?

Which expense is the highest?

📈 Trend Analysis

Sales growing but profit flat?

Expenses increasing faster than income?

📈 Trend Analysis

Sales growing but profit flat?

Expenses increasing faster than income?

🚀 Growth Signals

Healthy profits and equity?

Safe to reinvest in stock, ads, or tools?

Action example:

P&L shows $1,000 spent on ads with poor results → Pause campaigns → Save $500 next month.

💬 Want to Learn More?

This guide covers the core bookkeeping process every small business should understand.

If you’d like us to explain more topics such as:

Real-life bookkeeping examples

Common bookkeeping mistakes

Inventory tracking in detail

Tax basics for small businesses

Or how to set up bookkeeping from zero

👉 Leave a comment below and tell us what you want to learn next.

We’ll cover it in the next part of this series.