Picture this: It’s April 2, 2025, and the U.S. government, with a flick of a pen, unleashes a 44% tariff on Sri Lanka’s exports, set to hit on April 9. For a small island nation clawing its way back from the economic abyss of 2022, this isn’t just a policy shift—it’s a thunderclap. The U.S. isn’t some sidekick in Sri Lanka’s trade story; it’s the leading man, gobbling up 23% of the country’s exports—$3 billion in 2024 alone. That’s apparel stitching together livelihoods, tea steeping in tradition, and rubber rolling out resilience. Now, a tariff wall threatens to topple it all. I’m here to walk you through the wreckage—and the faint glimmers of hope—sector by sector, number by number.

The Export Engine Stalls

Sri Lanka’s economy runs on exports like a car runs on fuel. The U.S. market—$3 billion of the $11.8 billion total in 2024—is the premium octane. Strip that away, and the engine sputters. Let’s dissect the damage across the big players.

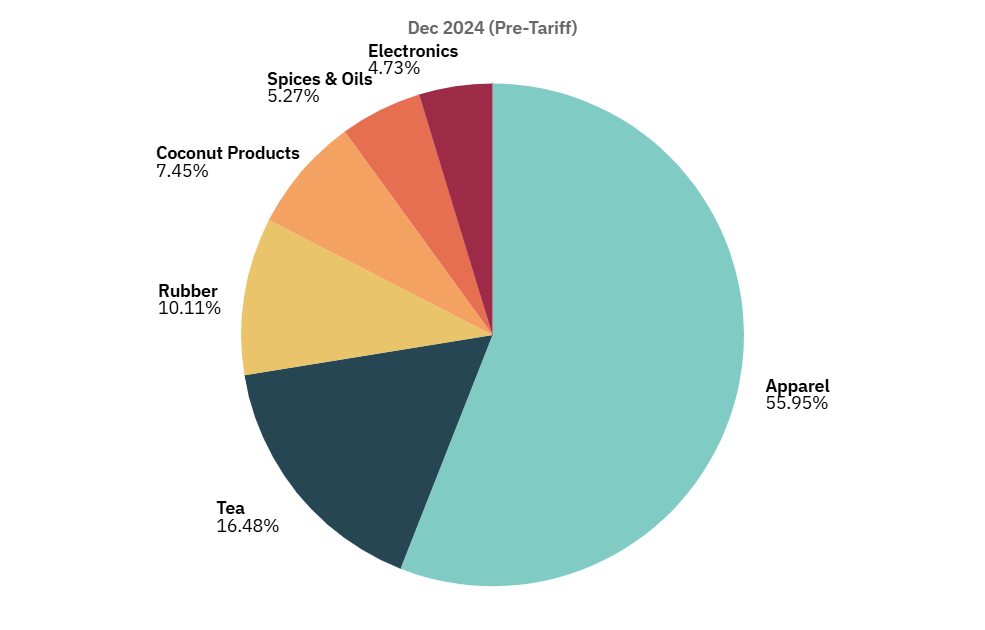

Apparel: The King’s Crown Slips

Last December, apparel exports strutted to $446.84 million, up 1.83% from 2023. This sector’s the heavyweight champ—40% of Sri Lanka’s export haul, employing over 300,000 people. The U.S. loves its affordable, quality threads. But slap a 44% tariff on that, and suddenly, a $50 shirt costs $72. American buyers balk, orders vanish, and factories idle. Projections? A $900 million revenue crater—think of it as losing a fifth of your paycheck overnight. Jobs? Thousands could unravel faster than a cheap sweater.

Tea: A Bitter Brew

Tea’s the soul of Sri Lanka—$131.6 million in December 2024, up 18.43%. Ceylon’s golden leaves charm U.S. shelves. But a 44% tariff jacks up prices, and suddenly, that $5 tin costs $7.20. Will Americans sip the difference, or switch to Kenya’s brew? Early signs say the latter. Sri Lanka’s scrambling for new markets, but tea doesn’t grow trade deals overnight. Expect a 5-8% drop—$120 million at best.

Rubber: Tires Deflate

Rubber rolled in $80.74 million last December, up 1.41%. Tires to the U.S. were a sweet spot. Then January 2025 hit: exports slid 8.15% to $75.06 million, with U.S. tire sales skidding 31.7%. That’s what happens when a $100 tire jumps to $144. Rural growers feel the pinch first—less cash, less planting, less hope.

Coconut: Oil Spills Over

Coconut products—$59.53 million in December 2024, up 6.47%—were a quiet success. Then January 2025: down 9.85% to $53.71 million. Desiccated coconut and oil, U.S. favorites, took the hardest hit. Small farmers, already stretched thin, watch their margins evaporate.

Spices: Flavor Fades

Spices like cinnamon spiced up $42.1 million in December 2024, up 4.9%. January 2025? Down 6.2% to $39.5 million. A 44% tariff turns a $10 jar of pepper into $14.40—too steep for U.S. spice racks.

Electronics: Circuits Short

Electronics sparked $37.8 million in December 2024, up 5.2%. A budding star—until January 2025, when exports dimmed 10.7% to $33.76 million. Higher costs zap competitiveness.

The Scorecard: Before Tariff

The Ripple Effect

Economics isn’t just exports—it’s a web. Tug one thread, and the whole thing quivers.

Can Sri Lanka Pivot?

The government’s not napping through this lecture. Here’s the playbook